HISTORY OF BLOCK CHAIN

History of blockchain

Blockchain has the potential to grow to be a bedrock of the worldwide record-keeping systems but was launched just 10 years ago. It was created by the unknown persons behind the online cash currency bitcoin, under the pseudonym of Satoshi Nakamoto.

Cryptographer David Chaum first proposed a blockchain-like protocol in his 1982 dissertation “Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups.” Further work on a cryptographically secured chain of blocks was described in 1991 by Stuart Haber and W. Scott Stornetta. They wanted to implement a system where document timestamps could not be tampered with. In 1992, Haber, Stornetta, and Dave Bayer incorporated Merkle trees into the design, which improved its efficiency by allowing several document certificates to be collected into one block.

The first blockchain was conceptualized by a person (or group of people) known as Satoshi Nakamoto in 2008. Nakamoto importantly improved the design using a Hashcash-like method to timestamp blocks without requiring them to be signed by a trusted party and introducing a difficulty parameter to stabilize the rate with which blocks are added to the chain. The design was implemented the following year by Nakamoto as a core component of the cryptocurrency bitcoin, where it serves as the public ledger for all transactions on the network.

In August 2014, the bitcoin blockchain file size, containing records of all transactions that have occurred on the network, reached 20 GB (gigabytes). In January 2015, the size had grown to almost 30 GB, and from January 2016 to January 2017, the bitcoin blockchain grew from 50 GB to 100 GB in size. The ledger size had exceeded 200 GiB by early 2020.

The words block and chain were used separately in Satoshi Nakamoto’s original paper but were eventually popularized as a single word, blockchain, by 2016.

According to Accenture, an application of the diffusion of innovations theory suggests that blockchains attained a 13.5% adoption rate within financial services in 2016, therefore reaching the early adopter's phase.[14] Industry trade groups joined to create the Global Blockchain Forum in 2016, an initiative of the Chamber of Digital Commerce.

In May 2018, Gartner found that only 1% of CIOs indicated any kind of blockchain adoption within their organizations, and only 8% of CIOs were in the short-term “planning or [looking at] active experimentation with blockchain”.

A brief history of blockchain:

1991

A cryptographically secured chain of blocks is described for the first time by Stuart Haber and W Scott Stornetta

1998

Computer scientist Nick Szabo works on ‘bit gold’, a decentralized digital currency

2000

Stefan Konst publishes his theory of cryptographically secured chains, plus ideas for implementation

2008

Developer(s) working under the pseudonym Satoshi Nakamoto released a white paper establishing the model for a blockchain

2009

Nakamoto implements the first blockchain as the public ledger for transactions made using bitcoin

2014

Blockchain technology is separated from the currency and its potential for other financial, inter-organizational transactions are explored. Blockchain 2.0 is born, referring to applications beyond currency

The Ethereum blockchain system introduces computer programs into the blocks, representing financial instruments such as bonds. These become known as smart contracts.

Bitcoin’s role

Posting their seminal whitepaper in 2008 and launching the initial code in 2009, Nakamoto created bitcoin to be a form of cash that could be sent peer-to-peer without the need for a central bank or other authority to operate and maintain the ledger, much as how physical cash can be.

While it wasn’t the first online currency to be proposed, the bitcoin proposal solved several problems in the field and has been by far the most successful version.

The engine that runs the bitcoin ledger that Nakamoto designed is called the blockchain; the original and largest blockchain is the one that still orchestrates bitcoin transactions today.

The second generation

Other blockchains include those that run the several hundred “altcoins” — other similar currency projects with different rules — as well as truly different applications, such as:

- Ethereum: the second-largest blockchain implementation after bitcoin. Ethereum distributes a currency called ether, but also allows for the storage and operation of computer code, allowing for smart contracts.

- Ripple: a real-time gross settlement system, currency exchange, and remittance network, based on a public ledger.

Structure

A blockchain is a decentralized, distributed, and oftentimes public, digital ledger consisting of records called blocks that are used to record transactions across many computers so that any involved block cannot be altered retroactively, without the alteration of all subsequent blocks. This allows the participants to verify and audit transactions independently and relatively inexpensively. A blockchain database is managed autonomously using a peer-to-peer network and a distributed timestamping server. They are authenticated by mass collaboration powered by collective self-interests. Such a design facilitates robust workflow where participants’ uncertainty regarding data security is marginal. The use of a blockchain removes the characteristic of infinite reproducibility from a digital asset. It confirms that each unit of value was transferred only once, solving the long-standing problem of double-spending. A blockchain has been described as a value-exchange protocol. A blockchain can maintain title rights because, when properly set up to detail the exchange agreement, it provides a record that compels offer and acceptance.

Logically, a blockchain can be seen as consisting of several layers:

- infrastructure (hardware)

- networking (node discovery, information propagation, and verification)

- consensus (proof of work, proof of stake)

- data (blocks, transactions)

- application (smart contracts/d Apps, if applicable)

Blocks

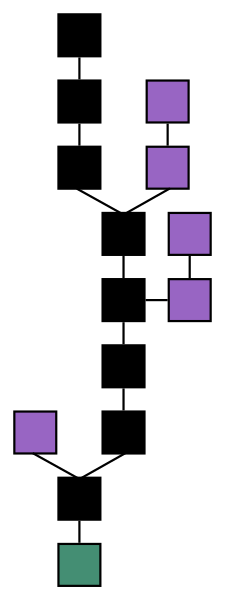

Blocks hold batches of valid transactions that are hashed and encoded into a Merkle tree. Each block includes the cryptographic hash of the prior block in the blockchain, linking the two. The linked blocks form a chain. This iterative process confirms the integrity of the previous block, all the way back to the initial block, which is known as the genesis block.

Sometimes separate blocks can be produced concurrently, creating a temporary fork. In addition to a secure hash-based history, any blockchain has a specified algorithm for scoring different versions of the history so that one with a higher score can be selected over others. Blocks not selected for inclusion in the chain are called orphan blocks. Peers supporting the database have different versions of the history from time to time. They keep only the highest-scoring version of the database known to them. Whenever a peer receives a higher-scoring version (usually the old version with a single new block added) they extend or overwrite their own database and retransmit the improvement to their peers. There is never an absolute guarantee that any particular entry will remain in the best version of history forever. Blockchains are typically built to add the score of new blocks onto old blocks and are given incentives to extend with new blocks rather than overwrite old blocks. Therefore, the probability of an entry becoming superseded decreases exponentially as more blocks are built on top of it, eventually becoming very low. For example, bitcoin uses a proof-of-work system, where the chain with the most cumulative proof-of-work is considered the valid one by the network. Several methods can be used to demonstrate a sufficient level of computation. Within a blockchain, the computation is carried out redundantly rather than in the traditional segregated and parallel manner.

Block time

The block time is the average time it takes for the network to generate one extra block in the blockchain. Some blockchains create a new block as frequently as every five seconds. By the time of block completion, the included data becomes verifiable. In cryptocurrency, this is practically when the transaction takes place, so a shorter block time means faster transactions. The block time for Ethereum is set to between 14 and 15 seconds, while for bitcoin it is on average 10 minutes.

Hard forks

This section is an excerpt from Fork (blockchain) § Hard fork

A hard fork is a rule change such that the software validating according to the old rules will see the blocks produced according to the new rules as invalid. In the case of a hard fork, all nodes meant to work following the new rules need to upgrade their software.

If one group of nodes continues to use the old software while the other nodes use the new software, a permanent split can occur. For example, Ethereum has hard-forked to “make whole” the investors in The DAO, which had been hacked by exploiting a vulnerability in its code. In this case, the fork resulted in a split creating Ethereum and Ethereum Classic chains. In 2014 the NXT community was asked to consider a hard fork that would have led to a rollback of the blockchain records to mitigate the effects of a theft of 50 million NXT from a major cryptocurrency exchange. The hard fork proposal was rejected, and some of the funds were recovered after negotiations and ransom payment. Alternatively, to prevent a permanent split, a majority of nodes using the new software may return to the old rules, as was the case of the bitcoin split on 12 March 2013.

Decentralization

By storing data across its peer-to-peer network, the blockchain eliminates some risks that come with data being held centrally.[3] The decentralized blockchain may use ad hoc message passing and distributed networking.

Peer-to-peer blockchain networks lack centralized points of vulnerability that computer crackers can exploit; likewise, it has no central point of failure. Blockchain security methods include the use of public-key cryptography. A public key (a long, random-looking string of numbers) is an address on the blockchain. Value tokens sent across the network are recorded as belonging to that address. A private key is like a password that gives its owner access to their digital assets or the means to otherwise interact with the various capabilities that blockchains now support. Data stored on the blockchain is generally considered incorruptible.

Every node in a decentralized system has a copy of the blockchain. Data quality is maintained by massive database replication and computational trust. No centralized “official” copy exists and no user is “trusted” more than any other. Transactions are broadcast to the network using the software. Messages are delivered on a best-effort basis. Mining nodes validate transactions, add them to the block they are building, and then broadcast the completed block to other nodes. Blockchains use various time-stamping schemes, such as proof-of-work, to serialize changes. Alternative consensus methods include proof-of-stake. The growth of a decentralized blockchain is accompanied by the risk of centralization because the computer resources required to process larger amounts of data become more expensive.

Openness

Open blockchains are more user-friendly than some traditional ownership records, which, while open to the public, still require physical access to view. Because all early blockchains were permissionless, controversy has arisen over the blockchain definition. An issue in this ongoing debate is whether a private system with verifiers tasked and authorized (permissioned) by a central authority should be considered a blockchain. Proponents of permissioned or private chains argue that the term “blockchain” may be applied to any data structure that batches data into time-stamped blocks. These blockchains serve as a distributed version of multi-version concurrency control (MVCC) in databases. Just as MVCC prevents two transactions from concurrently modifying a single object in a database, blockchains prevent two transactions from spending the same single output in a blockchain.30–31 Opponents say that permissioned systems resemble traditional corporate databases, not supporting decentralized data verification and that such systems are not hardened against operator tampering and revision. Nikolai Hampton of Computerworld said that “many in-house blockchain solutions will be nothing more than cumbersome databases,” and “without a clear security model, proprietary blockchains should be eyed with suspicion.”

Permissionless

An advantage to an open, permission-less, or public, blockchain network is that guarding against bad actors is not required and no access control is needed. This means that applications can be added to the network without the approval or trust of others, using the blockchain as a transport layer.

Bitcoin and other cryptocurrencies currently secure their blockchain by requiring new entries to include proof of work. To prolong the blockchain, bitcoin uses Hashcash puzzles. While Hashcash was designed in 1997 by Adam Back, the original idea was first proposed by Cynthia Dwork and Moni Naor and Eli Ponyatovski in their 1992 paper “Pricing via Processing or Combatting Junk Mail”.

In 2016, venture capital investment for blockchain-related projects was weakening in the USA but increasing in China. Bitcoin and many other cryptocurrencies use open (public) blockchains. As of April 2018, bitcoin has the highest market capitalization.

Permissioned (private) blockchain

See also: Distributed ledger

Permissioned blockchains use an access control layer to govern who has access to the network. In contrast to public blockchain networks, validators on private blockchain networks are vetted by the network owner. They do not rely on anonymous nodes to validate transactions nor do they benefit from the network effect. Permissioned blockchains can also go by the name of ‘consortium’ blockchains.[citation needed] It has been argued that permissioned blockchains can guarantee a certain level of decentralization, if carefully designed, as opposed to permission-less blockchains, which are often centralized in practice.

Disadvantages of private blockchain

Nikolai Hampton pointed out in Computerworld that “There is also no need for a ’51 percent attack on a private blockchain, as the private blockchain (most likely) already controls 100 percent of all block creation resources. If you could attack or damage the blockchain creation tools on a private corporate server, you could effectively control 100 percent of their network and alter transactions however you wished.” This has a set of particularly profound adverse implications during a financial crisis or debt crisis like the financial crisis of 2007–08, where politically powerful actors may make decisions that favor some groups at the expense of others, and “the bitcoin blockchain is protected by the massive group mining effort. It’s unlikely that any private blockchain will try to protect records using gigawatts of computing power — it’s time-consuming and expensive.” He also said, “Within a private blockchain there is also no ‘race’; there’s no incentive to use more power or discover blocks faster than competitors. This means that many in-house blockchain solutions will be nothing more than cumbersome databases.”

Blockchain analysis

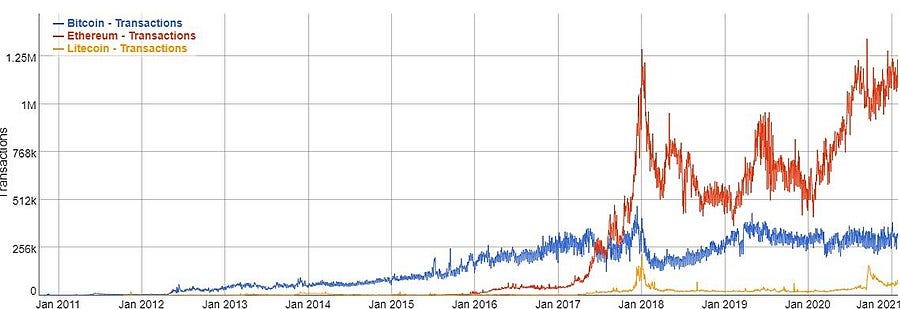

The analysis of public blockchains has become increasingly important with the popularity of bitcoin, Ethereum, lite coin, and other cryptocurrencies. A blockchain, if it is public, provides anyone who wants access to observe and analyze the chain data, given one has the know-how. The process of understanding and accessing the flow of crypto has been an issue for many cryptocurrencies, crypto-exchanges, and banks. The reason for this is accusations of blockchain-enabled cryptocurrencies enabling illicit dark market trade of drugs, weapons, money laundering, etc.[48] A common belief has been that cryptocurrency is private and untraceable, thus leading many actors to use it for illegal purposes. This is changing and now specialized tech companies provide blockchain tracking services, making crypto exchanges, law enforcement, and banks more aware of what is happening with crypto funds and fiat-crypto exchanges. The development, some argue, has led criminals to prioritize the use of new cryptos such as Monero. The question is about the public accessibility of blockchain data and the personal privacy of the very same data. It is a key debate in cryptocurrency and ultimately in the blockchain.

Comments